Why Business Owners Should Consider Dealing With Equity Firms?

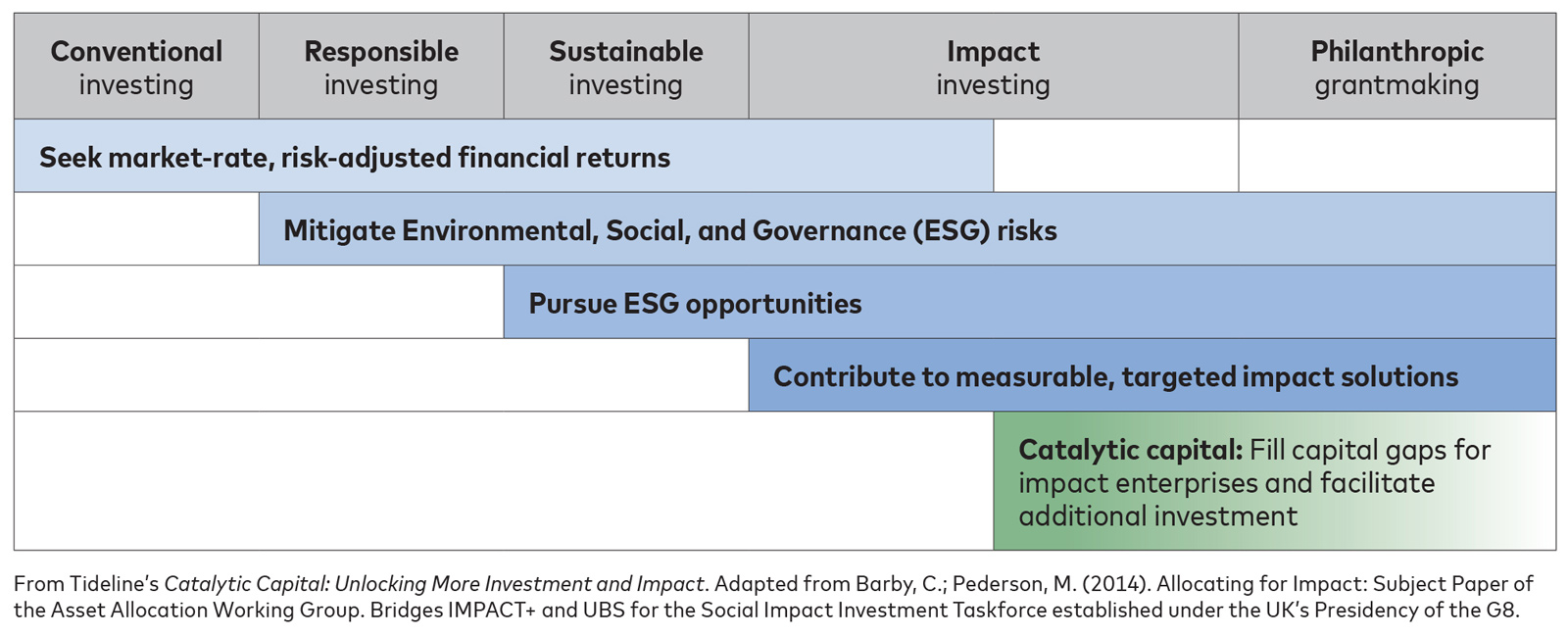

You can find out more about their full methodology here. There is a clear pattern sweeping the world. Services with an objective to affect change and earn a profit are drawing in big quantities of capital. With this wave and a newer way to do service likewise comes brand-new challenges, especially due to the fact that the spectrum of “impact” is so varied.

Because impact management methods– from specifying metrics and gathering data, to evaluating those data and reporting to investors (and other beneficiaries)– have actually ended up being essential. With that necessity there has actually likewise been an increase in impact investing tasks posts and a need for professionals who are well versed in these data management locations (in addition to the tools that will assist in an effective impact strategy).

For possessions themselves, business like Natgas, Sopact’s Impact Maker, utilizes Theory of Modification driven procedures and analytics tools to produce impact learnings for better tactical decision-making. Sopact’s professionals are also on hand every action of the way, so that adoption and efficient usage of these cloud-based tools can be executed.

A social impact fund exists to catalyze favorable effects through strategic capital allotment. Tyler T. Tysdal. Recognizing financial investment opportunities (the change creators) is what they need to be good at. But they likewise need to be proficient at making certain they measure impact. In this quick short article, we’ll share why we believe this last point is so essential, making the case for both investees and investors to take impact measurement seriously.

It deserves first defining what we mean by social impact fund. Simply put, such entities utilize pools of capital (sourced in various ways) to make impact investments in change-making companies. Funds have varying levels of threat aversion, both on the financial side and on the impact side. Tyler Tivis Tysdal. However usually speaking, they will look for some spread of returns on both sides, and might even determine impact at not just possession level, but also at broader portfolio and financier levels.

Commit Securities Fraud

The following 3 strategic factors shouldn’t be taken as the only three. We feel they are 3 of the most essential, in addition to one of the most standard reason of all: an impact fund require to know the degree of its impact returns. With that in mind, here are the reasons why we think that determining impact can and should form a core part of the method of impact funds.

.jpg)

There are some social impact funds that will not even make financial investments unless those prospective properties step impact (Tyler T. Tysdal). In any case, dealing with assets to make sure they have an understanding of impact measurement, and also the tools and resources (e.g. talent) to do so will make those assets much better at producing that impact in the long run.

Social impact funds likewise require to draw in individual investors and other sources of capital so that they can carry out those allotment methods. How might those interested celebrations who have cash in their pockets evaluate whether such a fund is worthy of those dollars? As with any financial investment, they will evaluate how likely is that the fund will attain its goals.

That means going beyond showing number of dollars invested or variety of social business bought, and really showing the impacts that those dollars have produced. What has altered in beneficiary lives since of it? That’s where impact is and where credibility lies. In traditional investing, a core part of the due diligence stage includes the evaluation of financial danger.

Nevertheless, doing so without information is virtually difficult, basically defaulting the response towards high threat because there is little to go on to determine an impact profile. Tyler Tysdal Lone Tree. If you and your fund is considering additional investment of an existing property in your portfolio that impact information needs to be clear, accessible, and timely.

Securities Fraud Theft

If we are to bring impact investing and social impact funds into the mainstream across the world, impact measurement needs to be a core part of that journey. Requiring impact accountability, when performed in a collective and supportive manner, helps assets step up also. If they are better able to report on their impact, they are likewise better able to use those insights to improve how they deliver impact to beneficiaries.

This is the appeal of impact data. You can put it to work to assist make better financing decisions and improve investment outcomes throughout a portfolio. We can help you get there by using our cloud-based platforms to work hand-in-hand with assets in the management of those important impact data.

Investors’ cravings for impact investingin which they look for to produce favorable impact for society alongside strong monetary returnscould total as much as $26 trillion, according to the report (Tyler T. Tysdal). The report is the most detailed assessment so far of the potential worldwide market for impact investing. It approximates that as much as $269 trillionthe financial properties held by organizations and homes across the worldis potentially readily available for investment.

The report approximates that in public markets including stocks and bonds, investor hunger might be as high as $21 trillion. An extra $5 trillion could come from personal equity, non-sovereign financial obligation, and equity capital. Turning this hunger into real investments will depend upon the creation of financial investment opportunities and financial investment automobiles that allow investors to pursue impact and monetary returns in manner ins which are sustainable.

So numerous of the world’s problems are intensified by the ruthless pursuit of profit at any cost. Recently, it’s stylish to invest billions in the next cool thing, while our overheating planet take care of itself. And it’s obvious that the wealthiest individuals on earth are getting richer as the incomes of many people worldwide stagnate. Tyler Tivis Tysdal – Tyler Tysdal.

Creek Family Offices

And investing isn’t broken. There are a great deal of investors out there, people like you, who feel highly about seeing that their financial investments have both a strong return AND a favorable impact. We’re hearing that a growing number of of you desire to be included and linked with positive results. Because we all understand we can’t happen with service as usual.

Does ESG sound a bell? This method evolved into socially responsible investing: NOT investing in stocks of publicly-held business that were bad for individuals and the planet. The focus has actually been on doing no wrong. The focus is on doing things right. Investors like us are looking at personal companies and direct financial investments.

The impact is deliberate, direct, and favorable. And the outcomes will be big. Tyler T. Tysdal. The reality is, we can innovate our escape of some extremely intractable issues, like lack of access to food, water and energy. We think deals that really matter can and need to provide solid returns. The rigor of the VC design can and will work with the core values of impact investing.

We are bringing life times of investment, service and development know-how to the table, rethinking both of these reliable approaches. Looking at them with a various set of values. In our world, effects have to deliver on the original intent in making the financial investment. Each impact business or business need to meet or go beyond recognized criteria (Tyler T. Tysdal).